Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son to land in his account by direct deposit on. Increases the tax credit amount.

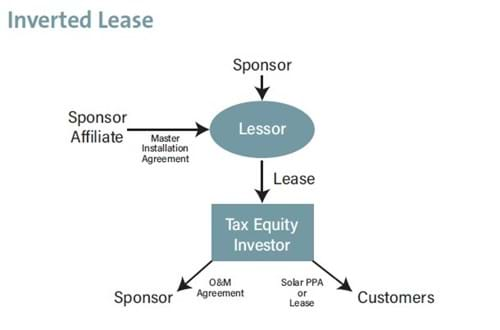

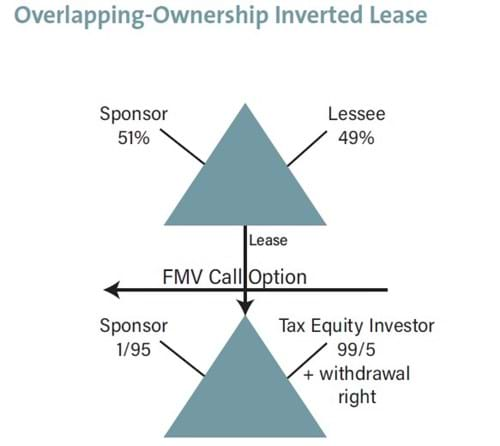

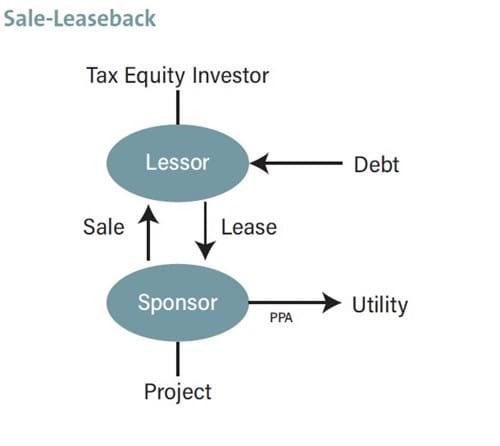

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew.

. The remaining money will come in one lump with tax refunds in 2021. To be a qualifying child for the 2021 tax year your dependent generally must. To stop all payments starting in October and for the rest of 2021 they must unenroll by 1159 pm.

ET on October 4 2021. Child tax credit payments still havent arrived for many eligible families in the US. Learn More At AARP.

Eligible families who make this choice will still receive the rest of their Child Tax Credit as a lump sum when they file their 2021 federal income tax return next year. September Advance Child Tax Credit. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The rebate caps at 750 for three kids. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

According to the IRS the vast majority of families got their payments as scheduled. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit. The advance is 50 of your child tax credit with the rest claimed on next years return.

For each qualifying child age 5 and younger up to. The 2021 CTC is different than before in 6 key ways. That drops to 3000 for each child ages six through 17.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. For 2021 the credit phases out in two different steps.

Parents should have received the most recent check from the IRS last week for up to. Those with kids between ages six and 17 will get 250 for every child. To get the full benefit single taxpayers.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Even if you dont owe taxes you could get the full CTC refund. Having received monthly Child Tax Credit payments in 2021 and any refund you receive as a result of claiming the Child Tax Credit is not considered income for any family.

Removes the minimum income requirement. More than 30million households are set to receive the payments worth up to 300 per child starting September 15. If the modified AGI is above the threshold the credit begins to phase out.

The March 2021 American Rescue Plan Act includes a credit of up to 3600 per year for children under age 6 and 3000 per year for children ages 6 to 17. Of families will receive 3000 per child ages. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

Likewise if a 17-year-old turns 18 in. Makes the credit fully refundable. E-File Your Tax Return Online.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Payments will start going out on September 15. But youre not completely out of luck.

Families with kids under the age of six will receive 300 per child. The Child Tax Credit does not affect your other Federal benefits. For families who are signed up each payment is up to 300 per month for each child under age 6 and up to 250 per month for each.

Heres who qualifies PDF. Fri September 24 2021. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600. August 17 2021 417 PM Updated.

But a fraction of the intended recipients who did not.

Tax Stimulus Checks See The 14 States That Are Sending Out Tax Rebate Payments Marca

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Apply For The New Ct Child Tax Rebate From June 1 To July 31 Ctlawhelp

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

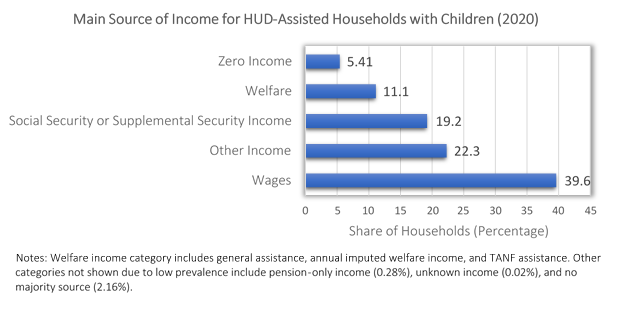

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

36 Million Families Face January Without A Child Tax Credit Check There Will Be Times I Won T Eat Cbs News

36 Million Families Face January Without A Child Tax Credit Check There Will Be Times I Won T Eat Cbs News

Child Tax Credit Delayed How To Track Your November Payment Marca

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Delayed How To Track Your November Payment Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

What If I Am Separated Or Divorced What If I Have Joint Custody Of My Child Who Will Get The 2021 Child Tax Credit And Advance Payments Get It Back

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

New Stimulus Checks Arrive September 15 Here S Who Gets The Money Wbff

36 Million Families Face January Without A Child Tax Credit Check There Will Be Times I Won T Eat Cbs News

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News